Real GDP

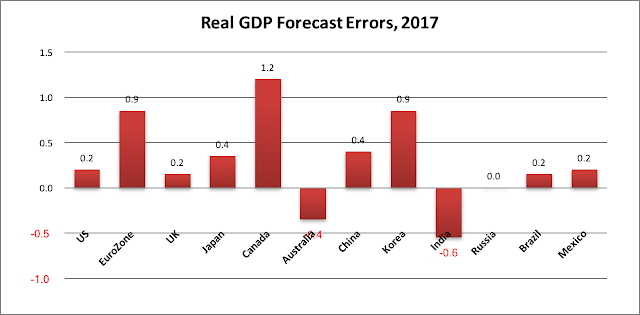

In 2017, for the first time in years, forecasters underestimated global real GDP growth. Average real GDP growth for the twelve countries we monitor is now expected to be 3.6% compared with a consensus forecast of 3.3%. In the twelve economies, real GDP growth exceeded forecasters' expectations in nine and fell short of expectations in just two. The weighted mean absolute forecast error for 2016 was 0.43 percentage points, down slightly from the 2016 error.

Based on current estimates, 2017 real GDP growth for the US exceeded the December 2016 consensus by 0.2 percentage points compared with a 0.8 downside miss in 2016. The biggest upside misses for 2017 were for Canada (+1.2 pct pts), Eurozone (+0.9), Korea (+0.9), China (+0.4) and Japan (+0.4). India's real GDP undershot forecasts by 0.6 pct pts and Australia by 0.4. On balance, it was the first year in seven that global growth exceeded consensus expectations.

CPI Inflation

Inflation forecasts for 2017 were, once again, too high. Average inflation for the twelve countries is now expected to be 2.2% compared with a consensus forecast of 2.5%. Eight of the twelve economies are on track for lower inflation than forecast, while inflation was higher than expected in three countries. The weighted mean absolute forecast error for 2016 for the 12 countries was 0.58 percentage points, a much larger average miss than last year.

The biggest downside misses on inflation were in Russia (-2.4 pct pts), Brazil (-1.1), China (-0.7), and Canada (-0.6). The biggest upside miss on inflation was in Mexico (+2.7 pct pts).

Central Bank Policy Rates

In 2017, for the first time in many years, economists' forecasts of central bank policy rates were too low.

In the DM, the Fed hiked the Fed Funds rate three times, more than the consensus expected. The ECB had been expected to keep its Refi rate unchanged, but surprised forecasters by lowering it to -0.4%. The Bank of Canada and the Bank of England had been expected to leave rates unchanged in 2017, but the BoC unexpectedly hiked twice and the BoE hiked once. In Australia, the consensus leaned toward a rate cut in 2017, but the RBA stayed on hold. The Bank of Japan met expectations and stayed on hold at -0.1%. In the EM, the picture was more mixed. Brazil's central bank was able to cut its policy rate much more than expected as inflation eased, while Russia was also able to cut its policy rate a bit more than expected. In China, the PBoC stayed on hold, as expected, while India's RBI eased 25bps, also in line with expectations. Mexico extended the trend of late 2016, tightening 100 bps more than expected as inflation rose sharply in delayed response to the weakening of the Mexican Peso as NAFTA came under heavy fire from the Trump Administration.

10-year Bond Yields

In six of the twelve economies, 10-year bond yield forecasts made one year ago were too high. Weaker than expected inflation combined with aggressive bond buying by the the ECB pulled 10-year yields down in most DM countries compared with forecasts of rising yields made a year ago.

In four of the six DM economies that we track, 10-year bond yields surprised strategists to the downside. The weighted average DM forecast error was -0.30 percentage points. The biggest misses were in the UK (-0.48 pct. pt.), US (-0.35), Eurozone (proxied by Germany, -0.34) and Australia (-0.30). In the EM, the picture was mixed as bond yields were lower than forecast where inflation fell more than expected, in Brazil (-2.05 pct pts) and Russia (-1.54). Bond yields were higher than expected in China, India and Mexico.

Exchange Rates

All of the major currencies (with the exception if the UK sterling) were stronger than expected against the US dollar. The weighted mean absolute forecast error for the 11 currencies versus the USD was 7.7% versus the forecast made a year ago, a larger error than last year.

The USD was expected to strengthen following the election of Donald Trump as President. Trump's criticism of the Fed during the 2016 election (implying that Fed Chair Janet Yellen would not be reappointed) and his plans for deregulation and fiscal stimulus had most forecasters expecting the USD to hold steady or strengthen against most currencies. As it turned out, delays in implementation of Trump's promises, hesitation by the Fed, unexpected tightening by some other central banks and ebbing political uncertainties in emerging countries saw the USD weaken against all currencies with the exception of Sterling, which struggled under the weight of Brexit uncertainty.

The biggest FX forecast misses were for the Euro (which was 10.8% stronger than expected), Russian Ruble (+10.1%) and Korean Won (+11.0%). The Canadian Dollar (+7.7%) and the Mexican Peso (+6.4%) were stronger than expected, despite NAFTA worries, as the central banks of both countries tightened more than forecasters had expected. China, India and Brazil also saw greater than expected currency strength.

Equity Markets

A year ago, equity strategists were optimistic that North American stock markets would turn in a modest, unspectacular positive performance in 2017. News outlets gather forecasts from high profile US strategists and Canadian bank-owned dealers. As shown below, those forecasts called for 2017 gains of 6.0% for the S&P500 and 4.3% for the S&PTSX Composite.

However, global real GDP growth surprised on the upside and global inflation surpassed on the downside, both misses being positive for equities. As of December 26, 2017, the S&P500, was up 19.9% year-to-date (not including dividends) for an error of +13.9 percentage points. The S&PTSX300 was up a more modest 5.8% for an error of +1.5 percentage points.

Globally, stock market performance (in local currency terms) was impressive. Japan and most emerging markets (with the exception of Russia) posted the best gains. Canada and Mexico were laggards.

Investment Implications

In 2017 global macro forecast misses were quite different from those of recent years. Real GDP growth exceeded expectations for the first time in seven years. CPI inflation continued to surprise on the downside, but several major central banks tightened more than expected despite weak inflation. However, the impact of higher than expected policy rates on bond yields was more than offset by the ECB's move to a significantly negative policy rate combined with continued large scale bond purchases. Consequently, even though major central banks tightened more than expected, bond yields came in lower than expected. And even though the US Fed led the move to tighten, the USD was weaker than expected against all of the major currencies expect UK Sterling.

Stronger than expected global growth, lower than expected inflation, and a smaller than expected rise in bond yields boosted equity performance in virtually all markets. US equities posted double-digit returns for a second consecutive year. The combination of better than expected real GDP growth and stimulative monetary policy boosted Japanese stocks and European stocks. Strong global growth and reduced political uncertainties facing Brazil and Russia helped lift Emerging Market equities to robust gains. In China, equity prices rebounded as Trump's protectionist campaign rhetoric against China was moderated by the US need for Chinese cooperation against North Korea's nuclear threat. Instead, Trump's protectionism was focussed on renegotiating NAFTA with Canada and Mexico, whose stock markets underperformed.

For Canadian investors, the stronger than expected appreciation of CAD against the USD meant that returns on investments in both equities and government bonds denominated in US dollars were reduced if the USD currency exposure was left unhedged. The biggest winners for unhedged Canadian investors were Eurozone, Japanese and Emerging Market equities.

The outperformance globally diversified portfolios over stay-at-home Canadian portfolios reasserted itself in 2017. As 2018 economic and financial market forecasts are rolled out, it is worth reflecting that such forecasts form a very uncertain basis for year-ahead investment strategies. While forecasters' optimism about global growth appears high, 2018 will undoubtedly once again see some large consensus forecast misses, as new surprises arise. The 2017 surprises, higher than expected growth and lower than expected inflation are now being built in to 2018 views. This actually increases the chances of disappointments that are negative for equities and other risk assets. With unconventional monetary stimulus being questioned and central banks belatedly beginning to focus on containing debt growth rather than hitting inflation targets, the scope for unfriendly surprises is rising.

No comments:

Post a Comment