I wasn't going to do this. I figured that after doing five years of "Biggest Macro Misses" that I had probably made my point. Economic and financial market forecasts that are rolled out at year end tend to be a poor guide for investment decisions for the year ahead. However, 2019 has seen both some of the biggest macro misses in years, but at the same time some remarkably good predictions of global equity market performance.

So, as another year comes to a close, here I go again. For probably the last time, I will review how the macro consensus forecasts for 2019 that were made a year ago fared.

Each December, I compile consensus economic and financial market forecasts for the year ahead. When the year comes to a close, I take a look back at the forecasts and compare them with what we now know actually occurred. I do this because markets generally do a good job of pricing in consensus views, but then move -- sometimes dramatically -- when different economic outcomes transpire. When we look back, with the benefit of hindsight, we can see what the macro surprises were and interpret the market movements the surprises generated. It's not only interesting to look back at the notable global macro misses and the biggest forecast errors of the past year, it also helps us to judge what were the macro drivers of 2019 investment returns and to assess whether they are sustainable.

Real GDP

A year ago, forecasters were overly optimistic about 2019 real GDP growth in the major economies. Weighted average real GDP growth for the twelve countries we monitor is now expected to be 3.0%, falling well short of the consensus forecast of 3.6% made a year ago. In the twelve economies, real GDP growth fell short of forecasters' expectations in eleven and met expectations in just one. The weighted mean absolute forecast error for the twelve countries was 0.6 percentage points, the biggest miss since 2015.

Based on current estimates, 2019 real GDP growth for Developed Market (DM) economies was 1.8% or 0.4% below last December's forecast, while growth for the Emerging Market (EM) economies that we follow was 4.6% or 0.7% below the forecast. Mexico, India, Australia and Korea had the biggest downside misses.

CPI Inflation

Just as for global growth, the consensus forecast for global inflation for 2019 was off the mark, overestimating inflation in most countries. Nine of the twelve economies are on track for lower inflation than forecast, while inflation was higher than expected in just two countries. The weighted mean absolute forecast error for 2018 for the 12 countries was 1.0 percentage points, again the biggest forecast misses since 2015.

The biggest downside misses on inflation were for Mexico (-1.6 pct pts), Korea (-1.5), the Eurozone (-1.0) and Brazil (-0.9). The biggest upside misses were for India (+2.8 pct pts) and China (+1.9), where food prices rose much more than expected.

Central Bank Policy Rates

In 2019, economists' forecasts of central bank policy rates missed badly. Ten of the twelve central banks either unexpectedly cut their policy rate or failed to hike their policy rate by as much as forecast. Two central banks met expectations by standing pat.

In the DM, the Fed was expected to hike the policy rate by 75 to 100 basis points but instead did a U-turn and cut rates by 75bps. Most other central banks followed the Fed's lead, eschewing rate hikes and cutting rates instead. Japan's BoJ and China's PBoC met expectations by leaving their policy rates unchanged. The Bank of Canada and the Bank of England held rates steady rather than delivering expected rate hikes. Policy rates fell much more than expected in most EM economies, even in India and China where inflation surprised to the upside.

10-year Bond Yields

Unfortunately, I was unable to collect meaningful 10-year bond yield forecasts for EM economies last year, so I will just compare DM forecasts with actual outcomes for 10-year yields.

For a second consecutive year, in all six DM economies that we track, 10-year bond yields surprised strategists to the downside. The US 10-year Treasury yield as expected to rise 55bps in 2019 as the Fed was expected to continue to tighten. Instead, US growth and inflation were weaker than expected, The Fed eased and the 10-year Treasury yield fell over 90bps. The weighted average DM forecast error was -1.22 percentage points, the biggest downside average miss since I began doing this in 2014. The biggest country miss was in Australia (-1.87 pct pts). The Aussie bond yield error was bigger than the year-end bond yield (1.60%). In the EM, bond yields also fell as global growth and inflation disappointed.

Exchange Rates

With the Fed doing a policy U-turn in early 2019, most exchange rate forecasts were upset. How currencies fared depended in large part on the degree to which other central banks matched the Fed's policy shift. All of the major currencies were weaker than expected against the US dollar. The weighted mean absolute forecast error for the 11 currencies versus the USD was 3.5%.

A year ago, most forecasters thought that after the USD had outperformed all expectations in 2018, other major currencies would rebound somewhat. Weaker than expected growth and inflation kept the ECB in ultra-accommodative mode and the Euro weakened rather than strengthened. Australia was another case where growth and inflation badly undershot expectations and the RBA responded by unexpectedly easing by as much as the Fed, sinking the Aussie dollar. In contrast, the Bank of Canada kept it's policy rate steady despite weaker than expected growth and the result was a stronger than expected Canadian dollar.

The biggest FX forecast misses for the DM economies were for the Euro (which was 7.4% weaker than expected) and the Australian Dollar (-6.9%). Among EM currencies, China and India saw depreciations that were in line with expectations, while Mexico and Russia experienced appreciations that were larger than expected as oil prices firmed.

Equity Markets

News outlets gather equity market forecasts from high profile US strategists and Canadian bank-owned dealers. A year ago, after a sharp global equity market correction in 4Q18, equity strategists were optimistic that North American stock markets would post a strong rebound in 2019. As shown below, those forecasts called for 2019 gains of 21% for the S&P500 and 13% for the S&PTSX Composite. They were right, but for the wrong reason. Global growth and inflation surprised forecasters to the downside, causing the Fed and other central banks to do a policy U-turn. Both bond and equity markets surged on the unexpected central bank reversal.

As of December 29, 2018, the S&P500, was up 30.3% year-to-date (not including dividends) for an error of +8.9 percentage points. The S&PTSX300 was up 20.7% for an error of +7.7 percentage points.

Globally, after horrible performance in 2018, stock markets rallied back along with US equities. US equities generally had more modest losses in 2018, followed by bigger gains in 2019 than other global equity markets.

Investment Implications

In 2019, global macro forecast misses were the biggest since 2014-15. Global growth and inflation were both weaker than expected, but an unexpected policy U-turn by global central banks resulted in unexpectedly strong returns for bonds and an even bigger than expected rebound in global equities from the late-2018 correction.

For Canadian investors, the appreciation of CAD against the USD meant that returns (in CAD terms) on foreign equities and government bonds were reduced if the USD currency exposure was left unhedged. US equities still outperformed Canadian equities in CAD terms, but Canadian equities outperformed most other global equity markets if foreign currency exposure was left unhedged. Meanwhile, Canadian bonds outperformed US Treasuries and other foreign government bonds in CAD terms despite the lack of policy easing by the BoC.

As 2020 economic and financial market forecasts are rolled out, it is worth reflecting that, for a variety of reasons, such forecasts have been a poor guide to investment decisions for several years running. While forecasters' are once again optimistic in light of the partial trade truce between the US and China, the lesson of 2019 is that forecasters have very limited ability to provide actionable investment guidance. 2020 will undoubtedly once again see some large consensus forecast misses as new surprises arise.

In 2018, aggregate global growth and inflation matched forecasters expectations, but portfolio returns fell far short of what was expected a year ago. At that time, the consensus forecast for global growth was the most optimistic in years and central banks were expected to continue on the path of unwinding monetary stimulus. The expectation among global strategists was for positive single-digit equity returns and weak bond market returns, consistent with consensus views that strong, synchronized global growth, Trump's tax cuts, and central bank withdrawal of stimulus would support equity returns while depressing bond returns. That is not what happened!

The focus of this blog is on generating good returns by taking reasonable risk in easily accessible global (including Canadian) ETFs. To assist in this endeavor, we track various portfolios made up of different combinations of Canadian and global ETFs. This allows us to monitor how the performance of the ETFs and the movement of foreign exchange rates affects the total returns and the volatility of portfolios.

Since we began monitoring our Global ETF portfolios at the end of 2011, we have found that the global portfolios we monitor have all vastly outperformed a simple all-Canada 60/40 portfolio. this proved true once again in 2018.

A stay-at-home Canadian investor who invested 60% of their funds in a Canadian stock ETF (XIU), 30% in a Canadian bond ETF (XBB), and 10% in a Canadian real return bond ETF (XRB) had a 2018 total return (including reinvested dividend and interest payments) of -5.2% in Canadian dollars. This virtually wiped out the all-Canada portfolio gain of 2017. All of our global ETF portfolios outperformed the all-Canadian portfolio in 2018.

Global Market ETFs: Performance for 2018

In 2018, with the CAD depreciating almost 8% against USD, over 4% against the JPY and relatively unchanged against the Euro, the best global ETF returns for Canadian investors were in US government bonds and gold. The worst returns were in Eurozone, Emerging Market and Canadian equities. The chart below shows 2018 returns, including reinvested dividends, for the ETFs tracked in this blog. The returns are shown in USD terms (green bars) and in CAD terms (blue bars).

Only one of the 19 Global ETFs that we track posted a positive USD total return in 2018. That was TLH, the Long-term (10-20yr) US Treasury Bond ETF, which returned +0.4% if monthly distributions were reinvested.

In CAD terms, returns on unhedged foreign currency ETFs were boosted by the depreciation of the Canadian dollar. The best gains were in the Long-term US Treasury Bond (TLH) which returned 8.8% in CAD terms and the US Treasury Inflation Protected Bonds (TIP) which returned 7.1%. Other gainers in CAD terms were the Non-US Government Bonds (BWX), the Gold (GLD), the US High Yield Corporate Bond (HYG), the US Investment Grade Corporate Bond (LQD). The only equity ETF to make a positive return in CAD terms was the S&P500 (SPY) which returned 3.5%. Small positive returns were also made in the USD Emerging Market Bond (EMB), the World Inflation Protected Bond (WIP), the Canadian Corporate Bond (XCB) and the Canadian Long Bond (XLB).

The worst performers in CAD terms were the Eurozone Equity ETF (FEZ) which returned -8.7%, the Emerging Market Equity (EEM) -8.1%, and the Canadian Equity (XIU) -7.8%. Other losers were the Japanese Equity (EWJ), the Commodity ETF (GSG), and the US Small Cap Equity (IWM).

Global ETF Portfolio Performance

In 2018, the global ETF portfolios tracked in this blog posted mixed returns in CAD terms when USD currency exposure was left unhedged, but negative returns when USD exposure was hedged. In a November 2014 post we explained why we prefer to leave USD currency exposure unhedged in our ETF portfolios.

A simple Canada only 60% equity/40% Bond Portfolio returned -5.2%, as mentioned at the top of this post. Among the global ETF portfolios that we track, the Global 60% Equity/40% Bond ETF Portfolio (including both Canadian and global equity and bond ETFs) returned -1.5% in CAD terms when USD exposure was left unhedged, and -5.6% if the USD exposure was hedged. A less volatile portfolio for cautious investors, the Global 45/25/30, comprised of 45% global equities, 25% government and corporate bonds and 30% cash, gained 0.5% if unhedged, but had a negative return of -3.8% if USD hedged.

Risk balanced portfolios outperformed in 2018 if left unhedged, but performed poorly if USD exposure was hedged. A Global Levered Risk Balanced (RB) Portfolio, which uses leverage to balance the expected risk contribution from the Global Market ETFs, gained 2.1% in CAD terms if USD-unhedged, but lost 5.6% if USD-hedged. An Unlevered Global Risk Balanced (RB) Portfolio, which has less exposure to government bonds, inflation-linked bonds and commodities but more exposure to corporate credit, returned 1.8% if USD-unhedged, but lost 4.4% if USD-hedged.

Four Key Events of 2018

In my view, there were four key economic and policy developments that left a mark on portfolio returns in 2018. The first was the interaction of the fiscal stimulus provided by President Trump's tax cuts and Federal Reserve's determination to normalize US monetary policy. The second was Trump's aggressive approach to trade policy, first in NAFTA negotiations and then in tariffs targeting China. The third was the increasing divergence between stronger than expected US growth and weaker than expected growth outside the US. The fourth was the Government of Canada's mismanagement of regulatory policies governing the building of pipelines to provide access for Canadian oil to world markets.

After a promising January, both bond and equity markets stumbled badly in February as an uptick in US wage growth prompted markets to price in more aggressive tightening by the Fed. At the same time, Trump threatened to pull out of NAFTA unless Canada and Mexico got serious about accepting US negotiating demands. As the wage uptick proved temporary and NAFTA negotiations resumed, Trump implemented steel and aluminum tariffs and began the process of ratcheting up tariffs on China. In the summer, Trump threatened to impose 25% tariffs on vehicles produced in Canada and Mexico, if they wouldn't agree with his NAFTA demands. Through this period, Emerging Market equities and currencies fell sharply. As global growth stumbled in 3Q, with both the Eurozone and Japan posting real GDP declines, weakness in equity markets spread to Europe, Japan and Canada. Slowing global growth, including in China, weakened commodity prices. Crude oil prices fell on slowing global demand and booming US supply. Canadian oil prices tanked, as the rising Canadian oilsands production was shut in by inadequate pipeline capacity. As risk markets sold off, volatility rose, and inflation plateaued, both the Fed and the Bank of Canada continued to signal steady withdrawal of monetary stimulus. Meanwhile, as the Republicans lost control of the House of Representatives, Trump continued to ratchet up tariff pressure on China, hoping to force a deal.

The impact on portfolio returns is clearly shown in the above chart. All portfolios stumbled in February-March, but recovered through the spring into mid-summer. Both US and Canadian equity equity markets managed to put in record highs as bond yields rose. The combination of slowing global growth, rising US-China trade frictions and central banks apparent unconcern about market volatility, proved a trifecta that led to the the sharp 4Q equity market correction and a muted bond market rally. When the Fed tightened for the fourth time of the year in December and Chairman Powell suggested that Fed balance sheet reduction was on auto pilot, it only added to the huge selloff in US and global equities in December. Only then did Fed officials begin to signal some flexibility on the monetary policy. But by this time, the damage to risk markets was done.

From their August highs in the +5 to 6% range, year-to-date returns for Canadian investors in Global ETF portfolios shrank to the -2 to +2% range in the final four months of the year. The All Canada Portfolio return sank from +3% in mid-July to -5% by yearend.

Looking Ahead

As we enter 2019, two crucial questions face markets. The first is whether "The Great Unwind" of unconventional monetary policy that began in mid-2017 will proceed as signaled by the FOMC or whether faltering momentum in the global economy will force central banks to pause indefinitely or even reverse course. The second is whether the US-China trade dispute will lead to a face-saving ceasefire or to an all-out trade war. The two issues are inter-related. Withdrawal of stimulus by the Fed spills over into tighter global financial conditions, pressuring China's highly leveraged economy. Trade tensions and tariff hikes weaken global growth and add to coast pressures, a toxic mix for equity markets.

While the consensus outlook expects slowing but still solid global growth in 2019, markets do not currently share most economists view of a "soft landing" and central banks withdraw stimulus. The best hopes for stronger portfolio performance for Canadian investors in 2019 would be a US-China trade truce, a Fed that pauses and reasserts "data dependence" as key for additional monetary policy normalization, and a U-turn in Canadian government policy toward resource development and transportation. If these hopes materialize, 2019 could be a very good year for investors. If not, the last four months of 2018 will likely prove to be just the beginning of a sustained bear market in risk assets.

As another year comes to a close, it is time to review how the macro consensus forecasts for 2018 that were made a year ago fared. Each December, I compile consensus economic and financial market forecasts for the year ahead. When the year comes to a close, I take a look back at the forecasts and compare them with what we now know actually occurred. I do this because markets generally do a good job of pricing in consensus views, but then move -- sometimes dramatically -- when a different outcomes transpire. When we look back, with 20/20 hindsight, we can see what the macro surprises were and interpret the market movements the surprises generated. It's not only interesting to look back at the notable global macro misses and the biggest forecast errors of the past year, it also helps us to understand the macro drivers of 2018 investment returns and to assess whether they are sustainable.

Real GDP

In 2018, forecasters accurately forecast global real GDP growth. Weighted average real GDP growth for the twelve countries we monitor is now expected to be 3.7%, exactly matching the consensus forecast of 3.7% made a year ago. While the global growth forecast was bang on, the individual country GDP forecasts were not. In the twelve economies, real GDP growth exceeded forecasters' expectations in just three and fell short of expectations in nine. The weighted mean absolute forecast error for the twelve countries was 0.4 percentage points, about the same as the 2017 error.

Based on current estimates, 2018 real GDP growth for the US exceeded the December 2017 consensus forecast by 0.5 percentage points (pct pts). Growth also slightly exceeded consensus expectations in Australia and China. The biggest downside misses on growth for 2018 were for Brazil (-1.5 pct pts), Japan (-0.7), Russia (-0.6), the Eurozone (-0.3), and India (-0.3). On balance, a big upside miss on US growth was offset by downside misses in other economies.

CPI Inflation

Just as for global growth, the consensus forecast for global inflation for 2018 was very accurate. Average inflation for the twelve countries is now expected to be 2.4% compared with a consensus forecast of 2.4%. And just as for growth, upside misses just offset downside misses. Six of the twelve economies are on track for higher inflation than forecast, while inflation was lower than expected in six countries. The weighted mean absolute forecast error for 2018 for the 12 countries was 0.4 percentage points, down from a 0.6% average miss last year.

The biggest downside misses on inflation were in India (-1.9 pct pts), and the UK (-0.3). The biggest upside miss on inflation were in Mexico (+1.1 pct pts) and the Eurozone (+0.6%).

Central Bank Policy Rates

In 2018, economists' forecasts of central bank policy rates were, on balance, slightly too high. Four central banks hiked their policy rate by more than expected while six central banks hiked less than expected.

In the DM, the Fed hiked the Fed Funds rate four times, one more than the consensus expected. The ECB and the BoJ met expectations by leaving their policy rates unchanged. The Bank of Canada and the Bank of England hiked slightly less than the consensus expectation. The Reserve Bank of Australia remained on hold instead of hiking once as the consensus expected. In the EM, as usual, the picture was more mixed. Brazil's central bank was able to cut its policy rate more than expected. Russia was expected to cut its policy rate but was unable to do so. In China, the PBoC stayed on hold, as expected, but did cut reserve requirements as the economy struggled to meet the government's growth target. India's RBI was expected to remain on hold in 2018, but had to raise its' policy rate. Mexico extended the trend of late 2016-17, tightening more than expected as inflation rose in response to the weakening of the Mexican Peso.

10-year Bond Yields

In nine of the twelve economies, 10-year bond yield forecasts made one year ago were too high.

In all six DM economies that we track, 10-year bond yields surprised strategists to the downside. The weighted average DM forecast error was -0.30 percentage points, the same as for 2017. The biggest misses were in Australia (-0.74 pct pts), Canada (-0.57), the Eurozone (proxied by Germany, -0.55), the UK (-0.35 pct. pt.). In the EM, the picture was mixed as bond yields were lower than forecast in Brazil (-1.78 pct pts) and Korea (-0.75). However, bond yields rose more than expected in Russia (+1.91), Mexico (+1.20) and India (0.36).

Exchange Rates

All of the major currencies were weaker than expected against the US dollar. The weighted mean absolute forecast error for the 11 currencies versus the USD was 7.5%.

The USD was expected to strengthen following the election of Donald Trump as President. In 2017, however, USD unexpectedly weakened reflecting early delays in implementation of Trump's promised tax cuts, hesitation to tighten by the Fed, unexpected tightening by some other central banks and ebbing political uncertainties in emerging economies. In 2018, as Trump's tax cuts took effect, the Fed hiked four times and shrank its' balance sheet, and Trump began his strategy of raising tariffs to pressure trading partners into more advantageous trade arrangements, the USD outperformed all expectations.

The biggest FX forecast misses for the DM economies were for the Canadian Dollar (which was 11.4% weaker than expected), the UK Pound (-9.3%), the Australian Dollar (-8.5%) and the Euro (-8.0%). EM currencies also weakened sharply against USD, led by the Russian Ruble (-17.2%), Brazilian Real (-15.5%) and Indian Rupee (-6.7%).

Equity Markets

News outlets gather equity market forecasts from high profile US strategists and Canadian bank-owned dealers. A year ago, equity strategists were optimistic that North American stock markets would turn in a modest, if unspectacular, positive performance in 2018. This call was far off the mark. As shown below, those forecasts called for 2018 gains of 5.7% for the S&P500 and 4.9% for the S&PTSX Composite.

As of December 21, 2018, the S&P500, was down 9.2% year-to-date (not including dividends) for an error of -14.9 percentage points. The S&PTSX300 was down 14.0% for an error of -18.9 percentage points.

Although global real GDP growth, global inflation and major central bank actions were close to consensus forecasts, the divergences from consensus expectations across countries proved a toxic mix for equities. Stronger than expected US growth and a slight uptick of inflation were met with a slightly quicker normalization of the US policy rate and a steady reduction in the size of the Fed's balance sheet. As the Fed persisted with plans to continue tightening amid slowing growth in Europe, Japan and Emerging Markets, equity markets fell like dominoes. Declines began in EM, spread to Europe and Japan, and finally reached US equity markets in the final two months of 2018.

Globally, stock market performance (in local currency terms) was horrible. The Eurozone and Canada led declines in DM equity markets. China, Korea and Mexico led decliners in EM markets. Brazil and India, bucking the global trend, posted gains.

Investment Implications

In 2018 global macro forecast misses were once again quite different from those of recent years. The accuracy of global growth and inflation forecasts masked unexpected divergences in growth and inflation from expectations for individual countries. Stronger than expected US growth, faster than expected Fed tightening and Trump's tariff increases saw the USD strengthen against all of the major currencies. This mix was particularly difficult for EM economies, including China, with large amounts of USD-denominated debt. As EM economies slowed, crude oil and other commodity prices fell sharply, dimming prospects for countries like Canada and Australia.

Stronger than expected growth had US stocks outperforming bonds for most of the year. Market concerns that the Fed would continue tightening even as growth outside the US was faltering contributed to the sharp fall in global equity prices in 4Q18. By year end, both US equity and bond prices had fallen, but bonds outperformed as risk aversion took hold.

For Canadian investors, the depreciation of CAD against the USD meant that returns (in CAD terms) on government bonds denominated in US dollars were boosted if the USD currency exposure was left unhedged. The only slight positive returns for Canadian investors came in Canadian and unhedged foreign bonds. The outperformance of globally diversified portfolios over stay-at-home Canadian portfolios continued in 2018.

As 2019 economic and financial market forecasts are rolled out, it is worth reflecting that, for a variety of reasons, such forecasts have been a poor guide to investment decisions for several years running. While forecasters' optimism about global growth remains in place, cracks are now forming. 2019 will undoubtedly once again see some large consensus forecast misses, as new surprises arise.

Last year in this space, I said:

The 2017 macro surprises, higher than expected growth and lower than expected inflation, are now being built in to 2018 views. This actually increases the chances of disappointments that are negative for equities and other risk assets.

Although it took until late in the year, those disappointments did arrive in 2018. This has left the global economy and financial markets in an uncertain and somewhat precarious position heading into 2019. With central banks focussed on "normalizing" monetary policy, the buoyant financial market performance that accompanied massive expansion of central bank balance sheets is increasingly looking like it's going into reverse.

The conventional view serves to protect us from the painful job of thinking.

John Kenneth Galbraith

The Bank of Canada hiked it's policy rate by 25 basis points to 1.5% on July 11, in a move that was widely anticipated by the consensus.

As the C.D. Howe Institute's Monetary Policy Council (of which I am a member) said on July 5,

All but one of the nine MPC members who attended this meeting called for an overnight rate target higher than the current one at the upcoming meeting on Wednesday 11 July. The near unanimity reflected the group’s view that Canadian economic data in the second quarter have rebounded from a sluggish beginning to 2018. Output has risen since April, with the Business Outlook Survey suggesting we are at or above productive capacity. The labour market is also showing signs of tightening with growth in average hourly earnings at its highest level since 2008.

This is the conventional wisdom which nearly everyone with an educated opinion accepts. It is based on the notion that the economy has reached or exceeded its' full capacity. The unemployment rate, which ticked up last month, had previously fallen to its lowest since comparable data became available in 1976. Wage growth, as measured by average hourly earnings of permanent employees reached 3.9% in May, the highest since 2008.

One analyst, who I have high regard for, recently wrote,

The Canadian economy is in an interesting position approaching the middle of 2018. Growth has slowed in recent quarters, after a very strong 2017H1. There are convincing signs, however, that this slowing reflects the economy hitting capacity constraints, rather than a sudden fall off in demand. Consistent with this, genuine inflation pressures have become more evident. Canada is the only G7 country to experience a significant acceleration in wage inflation as the unemployment rate has fallen below traditional estimates of NAIRU.All these factors suggest that the Bank of Canada is behind the curve on its policy of rate normalization.

When I read such analysis or the financial press, the message that comes through is that:

- Because growth of demand (or GDP) has been stronger than potential, Canada's economy has reached or exceeded it's full productive capacity; and

- Because the labour market has reached a 40+ year tightness, wage growth is accelerating and putting upward pressure on inflation;

- The Bank of Canada should play catch up in "normalizing" it's policy rate.

I believe that neither of the first two points is an accurate description of the current situation in Canada and therefore, that the conclusion about Bank of Canada policy does not follow.

Why is Canada facing capacity pressures?

I don’t share the view that growth has slowed because of capacity constraints that have pushed up wages. I believe the latest acceleration in wages in a slowing economy was driven by sharp increases in minimum wages in several provinces, which began in 2017.

Across Canada's ten provinces, the minimum wage rose by a weighted average 4.1% in 2017 (led by an 11.5% hike in Alberta) and by 11.0% in 2018 (led by a 20.7% hike in Ontario). Minimum wage hikes, not excess labour demand, have forced employers to raise wages not only for minimum wage employees, but also for employees who had moved to above-minimum-wage status, to maintain some equity and premium for experience. With 15% of employees affected directly or indirectly, these minimum wage hikes are sufficient to explain the majority of the acceleration average hourly wages for the total workforce. The sharp increase in early 2018 is probably also partly responsible for employment having declined 50,000 in the first five months of 2018.

I would characterize capacity utilization reaching cyclical highs even as growth has slowed as being caused by insufficient business non-residential investment. The chart below compares Canada and US real nonresidential business investment to GDP.

Over the past two decades, Canada has lagged the United States in business investment in plant, equipment and intellectual property. Canada's real investment rose as a percentage of GDP in the periods leading into 2008 and into 2014 when global crude oil prices were strong, boosting investment in Canada's oil and gas industry, led by growth of oil-sands production. Since the collapse of crude oil prices in 2014, followed by aggressive new government regulations and taxes in pursuit of climate change objectives, Canadian business investment fell to recessionary levels in 2016-17. While US business investment as a percentage of GDP has risen to a 20-year high, Canada's investment has fallen toward two decade lows.

The mix of Canada's business investment also demonstrates weakness. The charts below show Canada-U.S. comparisons of business spending on machinery and equipment, nonresidential structures and intellectual property.

US spending on machinery and equipment reached 6.5% of GDP in 1Q18, its' highest level in over 20 years. Meanwhile, Canada's spending on M&E was one-third lower at just 4.1% of GDP, still below the level reached prior to the Great Financial Crisis.

US business spending on intellectual property has been rising strongly and reached 4.5% of GDP in 1Q18. This was well over double Canada's spending of just 1.8% of GDP.

Canada's business spending on non-residential structures rose to 5.5% of GDP in 1Q18, well below the peak level of 7.5% reached in 2Q14. The decline in crude oil prices slowed energy investment after 2014 and increased regulation stalled investment in pipeline building. Canada still devotes almost double the US investment to nonresidential structures.

Canada's mix of business investment, which has been heavily skewed toward energy investment is a disadvantage when crude oil prices are weak and when governments prioritize environmental concerns. Canada has badly lagged the United States for decades in investment in machinery and equipment and intellectual property, but in both cases the US is opening up a widening gap.

What's Behind Canada's Weak Business Investment?

To some extent, Canada's lagging business investment is the result of differences in the industrial structure of the two countries. Canada has abundant natural resources and has long been a leader in capital investment in the extraction and transportation of these resources. When natural resource prices weaken or when governments adopt taxes and regulations that discourage resource development Canada's business investment can weaken quite dramatically. The United States has long been a leader in high technology industries and in the implementation of new technologies to increase business productivity and efficiency. As the pace of technological development accelerates, the US seems to be widening and deepening its advantage in business investment in both machinery and equipment and intellectual property.

While industrial structure is important, the influence of government policies can also be very important. Some recent policy developments in the US and Canada clearly seem to have tilted incentives toward higher investment in the US and weaker investment in Canada.

- Corporate Tax: The Trump Administration has lowered corporate tax rates and encouraged repatriation of foreign profits. Canada has, so far, left its corporate tax rates unchanged. In 2017, the federal government raised the ire of small business by suggesting that they were not paying their "fair share" or taxes, before backing down on proposed changes.

- Carbon Tax: The Government of Canada introduced a carbon tax of C$10 per tonne in 2018, rising to C$50 per tonne by 2022. The Trump Administration has pulled out of the Paris Climate Accord and the President has tweeted "I will not support or endorse a carbon tax!"

- Regulation: President Trump has instructed the Environmental Protection Agency to cut regulations on industry and speed up decisions on permits. In Canada, environmental regulations have been tightened and the process to gain approval for pipelines and other energy projects has been made more complicated and time-consuming (see here).

- Trade Policy: The Trump Administration has:

- demanded major changes to NAFTA which are unacceptable to Canada (and Mexico), thereby leaving negotiations in limbo;

- imposed a 20% duty on Canadian softwood lumber after the US Commerce Department ruled that Canada was unfairly subsidizing the industry (a claim made many times in the past but never upheld under WTO or NAFTA dispute settlement procedures);

- implemented 25% tariffs on steel and aluminum imports on "national security" grounds, refusing to exempt Canada, a close ally;

- threatened 25% tariffs on all auto imports, using the same "national security" justification.

Trump’s tax and regulatory moves and the uncertainty generated by his trade policies have discouraged business investment in key Canadian goods producing industries. Meanwhile Trudeau’s attempts to tighten small business tax rules and the introduction of new regulatory obstacles to pipeline building and other energy projects have curtailed Canada’s future ability to get oil to export markets, depressed prices of Canadian crude and discouraged investment.

The net result has been to tilt incentives to invest away from Canada and in favour of the United States. The comparative charts shown above of US and Canadian business investment-to-GDP provide strong evidence that this is the case. Further supporting evidence is provided by the chart below, which shows Canada's foreign direct investment flows.

The chart clearly shows that while Canadian direct investment abroad is near its' 20-year highs, foreign direct investment flows into Canada have fallen toward 20-year lows. US, Canadian and other foreign companies have a choice as to which side of the border to invest. They are increasingly choosing to invest in the US. The attraction of lower corporate taxes and reduced regulation combined with punitive US tariffs and uncertainty over the future of NAFTA provide powerful incentives to make capacity-expanding investment in the US, not in Canada.

What is Canada's Response?

So far, Canada has not responded effectively to Trump's tax and regulatory moves. On corporate taxes, the 2018 Federal Budget provided neither action nor a plan to revise Canada's corporate income tax, which prior to Trump's changes, had been relatively attractive.

The federal government has not budged on its' plan to enforce a Canada-wide carbon tax, but provincial governments in Saskatchewan and Ontario oppose the plan and a change of government in Alberta would add a third important opponent, making it difficult for the federal government to implement its' carbon tax plan. Uncertainty over the future of carbon taxes remains a negative for business investment.

On regulatory measures, the Trudeau government, after allowing a dysfunctional regulatory process to cause the Northern Gateway Pipeline and the Energy East Pipeline projects to die, approved the Trans-Mountain Pipeline. However, because of protests by the Government of British Columbia, environmental activists and indigenous groups, the private investor, Kinder Morgan, shelved the project. The Federal Government kept the project on life support by purchasing the Trans Mountain Pipeline from Kinder Morgan for C$4.5 billion and promising to build it. Opponents will still make strong efforts to block the project, leaving Canada with insufficient capacity to get its' oil to world markets.

On trade policy, the federal government has chosen to retaliate against Trump's steel and aluminum tariffs with and equal value of tariffs on a range of US imports, a move which could provoke Trump into further escalating the trade war. Trump has shot Canada in one foot with his tariffs and duties on lumber, steel and aluminum and his threats of tearing up NAFTA and imposing tariffs on autos. Trudeau has shot Canada in its' other foot by imposing tariffs on US goods consumed by Canadians and his rhetoric that Canada "will not be bullied", which has contributed to the standstill in NAFTA negotiations. Let's be clear: Trump's trade policies and threats are dangerous and, if carried out, pose a clear risk to the global growth. But retaliation by US trading partners only increases that risk.

Is Canada Operating at Full Capacity?

It seems clear to me that Canada's economy is suffering from an investment drought. While unemployment is low by historical standards, weak business investment is resulting in many Canadians working at jobs well below their potential. Self employment is at a record level. Young people have great difficulty finding jobs that match their education and qualifications. Higher levels of business investment would surely create more full time private sector employment and stronger GDP growth. Traditional measures may suggest that Canada is near full capacity, but in my view, it is nowhere near full potential.

I am hopeful, however, that the next few years will see Canadian voters electing governments more attuned to the necessity of building a positive investment climate. Change is already underway in Ontario and is pending in Alberta. Only when federal and provincial governments begin working together on a comprehensive strategy to improve the climate for business investment will Canada reach its' potential.

In the meantime, tightening monetary policy is unlikely to improve Canada's economic prospects. Bank of Canada tightening in response to politically motivated spikes in minimum wages or to temporary upward pressure on Canadian inflation from US and Canadian tariff hikes is clearly inappropriate. Until Canada is able to bring about a lasting improvement in its' investment climate, a Bank of Canada monetary policy strategy of standing pat while the US Fed tightens monetary policy more aggressively would tend to weaken the Canadian dollar, thereby providing a boost to our export competitiveness and a needed adjustment cushion the blow from US protectionism.

For the first time in seven years, the global economy outperformed expectations and the result was solid returns for Global ETF portfolios held by Canadians. At the end of 2016, the consensus among global strategists was for quite modest equity and bond market returns, consistent with consensus views that the US Fed would push up interest rates, thereby depressing expected bond returns, and skepticism that newly-elected President Trump could get his election promises through Congress, depressing expected equity returns.

The focus of this blog is on generating good returns by taking reasonable risk in easily accessible global (including Canadian) ETFs. To assist in this endeavor, we track various portfolios made up of different combinations of Canadian and global ETFs. This allows us to monitor how the performance of the ETFs and the movement of foreign exchange rates affects the total returns and the volatility of portfolios.

Since we began monitoring our Global ETF portfolios at the end of 2011, we have found that the global portfolios have all vastly outperformed a simple all-Canada 60/40 portfolio. In 2016, we saw a reversal, but the trend resumed in 2017.

A stay-at-home Canadian investor who invested 60% of their funds in a Canadian stock ETF (XIU), 30% in a Canadian bond ETF (XBB), and 10% in a Canadian real return bond ETF (XRB) had a 2017 total return (including reinvested dividend and interest payments) of 7.0% in Canadian dollars. This was half of the 13.9% gain generated by the same portfolio in 2016. Two of our global ETF portfolios outperformed the all-Canadian portfolio, while two others underperformed.

Global Market ETFs: Performance for 2017

In 2017, with the CAD appreciating almost 7% against USD but depreciating almost 6% against the Euro, the best global ETF returns for Canadian investors were in global equities. The worst returns were in US bonds. The chart below shows 2017 returns, including reinvested dividends, in CAD terms, for the ETFs tracked in this blog. The returns are shown for the full year (green bars) and for the "Great Unwind" period following a coordinated move by central banks in early-June to signal a reduction in the extraordinary monetary ease that had been in place since the Great Financial Crisis of 2008-09.

Global ETF returns varied widely across the different asset classes in 2017. In CAD terms, 14 of 19 ETFs posted gains over the full year, while 5 posted losses.

The best gains were in the Emerging Market equity ETF (EEM) which returned a robust 28.4% in CAD terms. The Japanese Equity ETF (EWJ) was second best, returning 16.9%, followed closely by the Eurozone equity ETF (FEZ), which returned 16.8%. The S&P500 ETF (SPY) returned 13.9% in CAD terms, while the Canadian equity ETF (XIU) returned 9.6%.

The worst performers were the US Inflation-linked government bond ETF (TIP), which returned -3.7% in CAD terms. Other losers were the Long-term (10-20yr) US Treasury Bond (TLH), the US High-Yield Bond (HYG) and the US Investment Grade Corporate Bond (LQD). The losses on these bond ETFs occurred in the period of the Great Unwind.

Global ETF Portfolio Performance for 2016

In 2017, the global ETF portfolios tracked in this blog posted solid returns in CAD terms when USD currency exposure was left unhedged and even stronger returns when USD exposure was hedged. In a November 2014 post we explained why we prefer to leave USD currency exposure unhedged in our ETF portfolios.

A simple Canada only 60% equity/40% Bond Portfolio returned 7.0%, as mentioned at the top of this post. Among the global ETF portfolios that we track, the Global 60% Equity/40% Bond ETF Portfolio (including both Canadian and global equity and bond ETFs) returned 10.4% in CAD terms when USD exposure was left unhedged, and 13.4% if the USD exposure was hedged. A less volatile portfolio for cautious investors, the Global 45/25/30, comprised of 45% global equities, 25% government and corporate bonds and 30% cash, gained 8.2% if unhedged, and 11.4% if USD hedged.

Risk balanced portfolios underperformed in 2017 if left unhedged, but performed well if USD exposure was hedged. A Global Levered Risk Balanced (RB) Portfolio, which uses leverage to balance the expected risk contribution from the Global Market ETFs, gained a 5.3% in CAD terms if USD-unhedged, but had a strong return of 13.6% if USD-hedged. An Unlevered Global Risk Balanced (RB) Portfolio, which has less exposure to government bonds, inflation-linked bonds and commodities but more exposure to corporate credit, returned 5.8% if USD-unhedged, but 11.0% if USD-hedged.

Four Key Events of 2017

In my view, there were four key policy developments that left a mark on Canadian portfolio returns in 2017. The first was the Bank of Canada's poorly telegraphed decision to raise the policy rate. The second was the loosely coordinated move by central banks in June to signal an unwinding of monetary stimulus (at different speeds), which contributed to divergences in relative equity and bond market performances across the major regions. The third was the US Congress' inability to repeal ObamaCare followed by its surprising success in passing sweeping, business-friendly tax reforms in December. The fourth was the Trump Administration's decision to focus its trade policy attention on its NAFTA grievances rather than its complaints about its unbalanced trade with China and other countries. Geopolitical stress associated with North Korea's defiant pursuit of nuclear weapons capable of striking the mainland US also played a role. The impact of these developments can be seen in the chart below which tracks weekly portfolio returns over the course of 2017.

After stumbling through Trump's inauguration, portfolio returns were strong into early June. Then "The Great Unwind" began, as within short order the ECB, BoC, Fed and BoE one after another announced less dovish/more hawkish forward guidance and policy rate actions. ECB President Draghi mused about reducing bond purchases. The Bank of Canada, which had talked of the possibility of cutting rates in January, did a quick U-turn and signalled an early rate hike which came in July. In a well-telegraphed move, the Fed raised the Fed Funds target on June 14 and discussed plans to reduce its balance sheet. After cutting rates following the 2016 Brexit vote, BoE Governor Carney signalled the need to raise rates despite the ongoing uncertainty around the Brexit negotiations. The net result of the central banks' Great Unwind guidance was to push up bond yields and push down the US dollar.

The impact on portfolio returns is clearly shown in the above chart. All portfolios suffered from early June through Labour Day. The Canadian dollar surged as much as 10% and bond ETFs faltered. This hit the global risk balanced portfolios hard, with the Leveraged RB portfolio taking the biggest hit. By Labour Day, with North Korean tensions at their peak, with the US Congress' failure to repeal ObamaCare, and with dim prospects for meaningful tax reform, year-to-date returns for Canadian investors in Global ETF portfolios had shrunk from the 6 to 8% range in early June to the +2% to -2% range.

The final four months of 2017 saw the losses recouped. Trump cut a deal with Democrats to avoid a government shutdown. US-North Korean tensions peaked without further escalation. Global growth continued to surprise on the upside, but inflation failed to accelerate. ECB and BoJ asset purchases continued apace. US tax reform negotiations gained momentum and, though messy as usual, culminated with the passage of the most sweeping tax overhaul since Ronald Reagan.

Meanwhile, after two rate hikes in July and September, the Bank of Canada adopted a more cautious stance. With the economy slowing and NAFTA negotiations going nowhere, the Canadian dollar weakened a bit in 4Q17. The result was a strong recovery in global ETF portfolio returns led by US, Japanese and Emerging Market equities.

Looking Ahead

As we enter 2018, the interesting question is whether "The Great Unwind" of unconventional monetary policy will proceed and possibly pick up pace. The results of 2017 suggest that in periods when withdrawal of central bank stimulus accelerates, bond yields tend to rise and currency moves tend to reflect how aggressively central banks change their guidance.

With the most optimistic consensus outlook on global growth in years, it is ironic that the best hope for strong Global ETF portfolio performance for Canadian investors in 2018 would be for Canadian growth and inflation to underperform expectations, thereby allowing the Bank of Canada to withdraw monetary ease more slowly than other major central banks.

As the year comes to a close, it is time to review how the macro consensus forecasts for 2017 that were made a year ago fared. Each December, I compile consensus economic and financial market forecasts for the year ahead. When the year comes to a close, I take a look back at the forecasts and compare them with what we now know actually occurred. I do this because markets generally do a good job of pricing in consensus views, but then move -- sometimes dramatically -- when a different outcome transpires. When we look back, with 20/20 hindsight, we can see what the surprises were and interpret the market movements the surprises generated. It's not only interesting to look back at the notable global macro misses and the biggest forecast errors of the past year, it also helps us to understand 2017 investment returns and to assess whether they are sustainable.

Real GDP

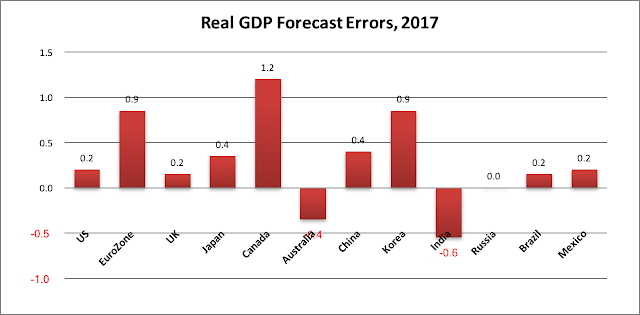

In 2017, for the first time in years, forecasters underestimated global real GDP growth. Average real GDP growth for the twelve countries we monitor is now expected to be 3.6% compared with a consensus forecast of 3.3%. In the twelve economies, real GDP growth exceeded forecasters' expectations in nine and fell short of expectations in just two. The weighted mean absolute forecast error for 2016 was 0.43 percentage points, down slightly from the 2016 error.

Based on current estimates, 2017 real GDP growth for the US exceeded the December 2016 consensus by 0.2 percentage points compared with a 0.8 downside miss in 2016. The biggest upside misses for 2017 were for Canada (+1.2 pct pts), Eurozone (+0.9), Korea (+0.9), China (+0.4) and Japan (+0.4). India's real GDP undershot forecasts by 0.6 pct pts and Australia by 0.4. On balance, it was the first year in seven that global growth exceeded consensus expectations.

CPI Inflation

Inflation forecasts for 2017 were, once again, too high. Average inflation for the twelve countries is now expected to be 2.2% compared with a consensus forecast of 2.5%. Eight of the twelve economies are on track for lower inflation than forecast, while inflation was higher than expected in three countries. The weighted mean absolute forecast error for 2016 for the 12 countries was 0.58 percentage points, a much larger average miss than last year.

The biggest downside misses on inflation were in Russia (-2.4 pct pts), Brazil (-1.1), China (-0.7), and Canada (-0.6). The biggest upside miss on inflation was in Mexico (+2.7 pct pts).

Central Bank Policy Rates

In 2017, for the first time in many years, economists' forecasts of central bank policy rates were too low.

In the DM, the Fed hiked the Fed Funds rate three times, more than the consensus expected. The ECB had been expected to keep its Refi rate unchanged, but surprised forecasters by lowering it to -0.4%. The Bank of Canada and the Bank of England had been expected to leave rates unchanged in 2017, but the BoC unexpectedly hiked twice and the BoE hiked once. In Australia, the consensus leaned toward a rate cut in 2017, but the RBA stayed on hold. The Bank of Japan met expectations and stayed on hold at -0.1%. In the EM, the picture was more mixed. Brazil's central bank was able to cut its policy rate much more than expected as inflation eased, while Russia was also able to cut its policy rate a bit more than expected. In China, the PBoC stayed on hold, as expected, while India's RBI eased 25bps, also in line with expectations. Mexico extended the trend of late 2016, tightening 100 bps more than expected as inflation rose sharply in delayed response to the weakening of the Mexican Peso as NAFTA came under heavy fire from the Trump Administration.

10-year Bond Yields

In six of the twelve economies, 10-year bond yield forecasts made one year ago were too high. Weaker than expected inflation combined with aggressive bond buying by the the ECB pulled 10-year yields down in most DM countries compared with forecasts of rising yields made a year ago.

In four of the six DM economies that we track, 10-year bond yields surprised strategists to the downside. The weighted average DM forecast error was -0.30 percentage points. The biggest misses were in the UK (-0.48 pct. pt.), US (-0.35), Eurozone (proxied by Germany, -0.34) and Australia (-0.30). In the EM, the picture was mixed as bond yields were lower than forecast where inflation fell more than expected, in Brazil (-2.05 pct pts) and Russia (-1.54). Bond yields were higher than expected in China, India and Mexico.

Exchange Rates

All of the major currencies (with the exception if the UK sterling) were stronger than expected against the US dollar. The weighted mean absolute forecast error for the 11 currencies versus the USD was 7.7% versus the forecast made a year ago, a larger error than last year.

The USD was expected to strengthen following the election of Donald Trump as President. Trump's criticism of the Fed during the 2016 election (implying that Fed Chair Janet Yellen would not be reappointed) and his plans for deregulation and fiscal stimulus had most forecasters expecting the USD to hold steady or strengthen against most currencies. As it turned out, delays in implementation of Trump's promises, hesitation by the Fed, unexpected tightening by some other central banks and ebbing political uncertainties in emerging countries saw the USD weaken against all currencies with the exception of Sterling, which struggled under the weight of Brexit uncertainty.

The biggest FX forecast misses were for the Euro (which was 10.8% stronger than expected), Russian Ruble (+10.1%) and Korean Won (+11.0%). The Canadian Dollar (+7.7%) and the Mexican Peso (+6.4%) were stronger than expected, despite NAFTA worries, as the central banks of both countries tightened more than forecasters had expected. China, India and Brazil also saw greater than expected currency strength.

Equity Markets

A year ago, equity strategists were optimistic that North American stock markets would turn in a modest, unspectacular positive performance in 2017. News outlets gather forecasts from high profile US strategists and Canadian bank-owned dealers. As shown below, those forecasts called for 2017 gains of 6.0% for the S&P500 and 4.3% for the S&PTSX Composite.

However, global real GDP growth surprised on the upside and global inflation surpassed on the downside, both misses being positive for equities. As of December 26, 2017, the S&P500, was up 19.9% year-to-date (not including dividends) for an error of +13.9 percentage points. The S&PTSX300 was up a more modest 5.8% for an error of +1.5 percentage points.

Globally, stock market performance (in local currency terms) was impressive. Japan and most emerging markets (with the exception of Russia) posted the best gains. Canada and Mexico were laggards.

Investment Implications

In 2017 global macro forecast misses were quite different from those of recent years. Real GDP growth exceeded expectations for the first time in seven years. CPI inflation continued to surprise on the downside, but several major central banks tightened more than expected despite weak inflation. However, the impact of higher than expected policy rates on bond yields was more than offset by the ECB's move to a significantly negative policy rate combined with continued large scale bond purchases. Consequently, even though major central banks tightened more than expected, bond yields came in lower than expected. And even though the US Fed led the move to tighten, the USD was weaker than expected against all of the major currencies expect UK Sterling.

Stronger than expected global growth, lower than expected inflation, and a smaller than expected rise in bond yields boosted equity performance in virtually all markets. US equities posted double-digit returns for a second consecutive year. The combination of better than expected real GDP growth and stimulative monetary policy boosted Japanese stocks and European stocks. Strong global growth and reduced political uncertainties facing Brazil and Russia helped lift Emerging Market equities to robust gains. In China, equity prices rebounded as Trump's protectionist campaign rhetoric against China was moderated by the US need for Chinese cooperation against North Korea's nuclear threat. Instead, Trump's protectionism was focussed on renegotiating NAFTA with Canada and Mexico, whose stock markets underperformed.

For Canadian investors, the stronger than expected appreciation of CAD against the USD meant that returns on investments in both equities and government bonds denominated in US dollars were reduced if the USD currency exposure was left unhedged. The biggest winners for unhedged Canadian investors were Eurozone, Japanese and Emerging Market equities.

The outperformance globally diversified portfolios over stay-at-home Canadian portfolios reasserted itself in 2017. As 2018 economic and financial market forecasts are rolled out, it is worth reflecting that such forecasts form a very uncertain basis for year-ahead investment strategies. While forecasters' optimism about global growth appears high, 2018 will undoubtedly once again see some large consensus forecast misses, as new surprises arise. The 2017 surprises, higher than expected growth and lower than expected inflation are now being built in to 2018 views. This actually increases the chances of disappointments that are negative for equities and other risk assets. With unconventional monetary stimulus being questioned and central banks belatedly beginning to focus on containing debt growth rather than hitting inflation targets, the scope for unfriendly surprises is rising.